IRFC Share Price Target 2024: The Indian Railway Finance Corporation (IRFC) is a central government organisation that provides funding to the Indian Railways. The organization was established in 1986 year and maintained under the Ministry of Railways in India. Indian Railway Finance Corporation IRFC share price target 2024 is expected to reach 175 rupees by end of the December and IRFC share price target 2025 is expected to grow by Rs 364.

The company’s main objective is to collect finances by distributing bonds, shares and other assets to help make improvements to the Indian Railways infrastructure. This includes purchasing trains, constructing new lines, and developing other train related projects across India. The Indian central government owns the railway organisation, therefore it is categorised as a Public Sector Undertaking company.

IRFC Share Price 2024 Overview

- High: 142.23

- Low: 139.50

- UC Limit: 167.54

- LC Limit: 111.69

- All Time High: 229.00

- All Time Low: 19.30

- 52 Week High: 229.00

- 52 Week Low: 72.70

- Book Value Per Share: 37.63

- Dividend Yield: 1.07

- Market Cap: 182,514 Cr

IRFC Share Price Target Tomorrow 2024 to 2030

| IRFC Share Price Year | IRFC Share Price Target |

| 2024 | Rs 175 |

| 2025 | Rs 364 |

| 2026 | Rs 452 |

| 2027 | Rs 545 |

| 2028 | Rs 630 |

| 2029 | Rs 720 |

| 2030 | Rs 850 |

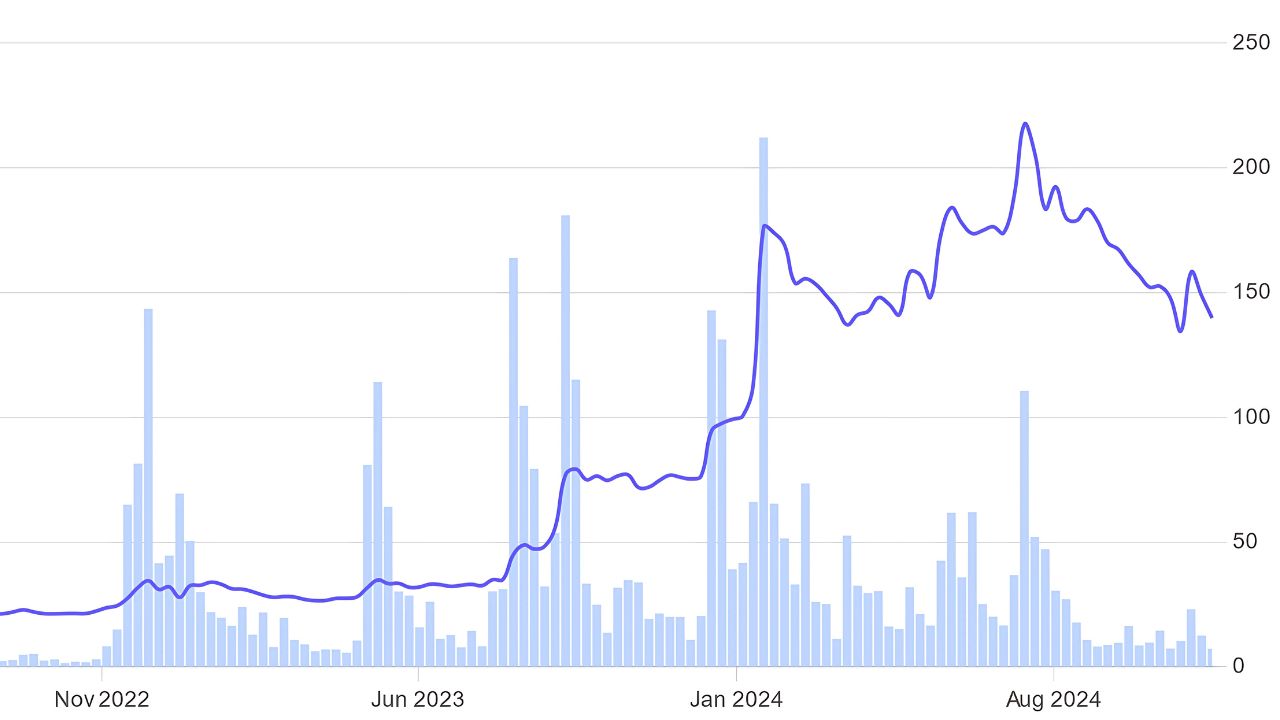

IRFC Share Price Graph

Shareholding Pattern For IRFC Share

- Promoters: 86.36%

- Retail And Others: 11.46%

- Foreign Institutions: 1.09%

- Other Domestic Institutions: 0.93%

- Mutual Funds: 0.15%

IRFC Share Performance

IRFC’s stock prices have been pretty much all over the place since it went public in January 2021. Right after it started selling shares, it was set at ₹25 during the IPO. The share price has been changing, and after 2022, it went up. The IRFC current share price is 140 rupees.

Government Rules and Money Plans: Since IRFC receives government support, its success really depends on what the Indian government decides to do with money and rules, especially regarding the train industry.

Infrastructure Development: The work the Indian Railways does to build and update stuff is a big deal for IRFC. Big investments in making things better and bigger could be a big help for the company.

Interest Rates: Since IRFC is all about money, it feels the pinch when interest rates go up. Higher interest rates mean it costs more to borrow money, which could mean less profit for IRFC.

Economy: Things like how the economy is doing, how fast it’s growing, how much prices are going up, and how much the government is spending can all affect IRFC’s stock price. A good economy usually means the IRFC does well.

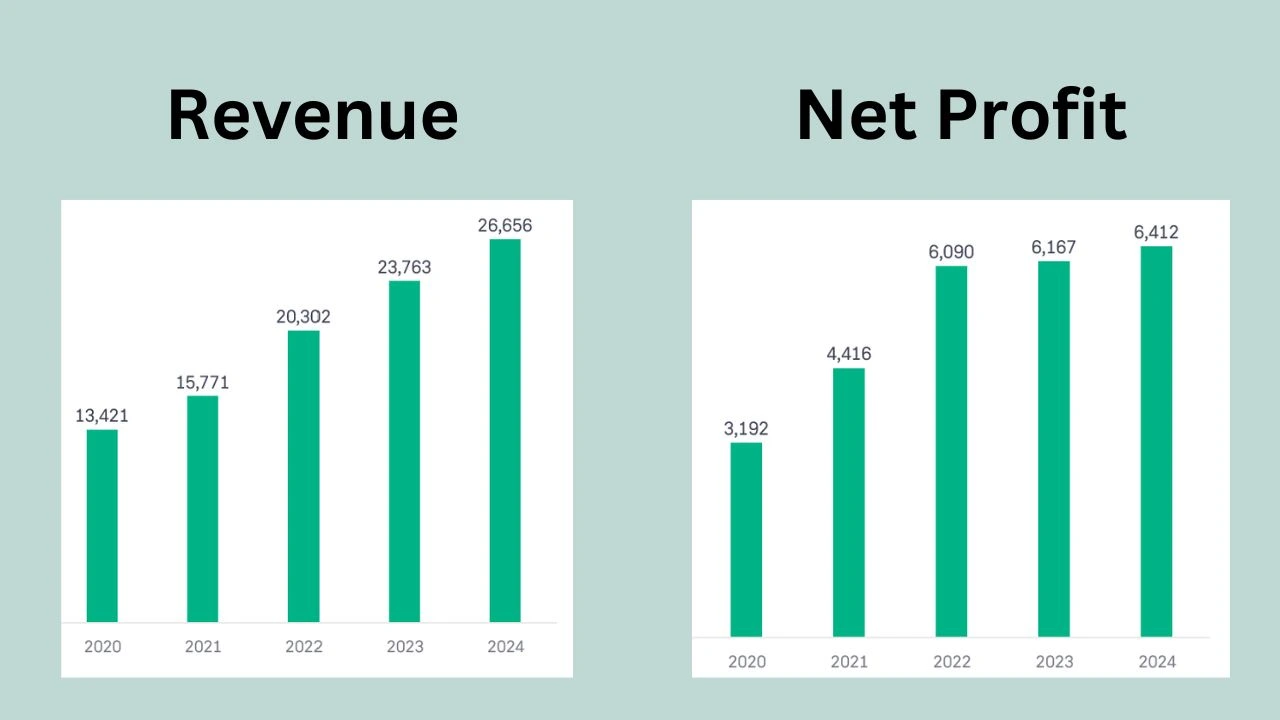

Indian Railway Finance Corp Ltd Financial Statement 2024

- Revenue: 26,656 Cr

- Expenses: 20,244 Cr

- Net Profit: 6,412 Cr

Financial Ratios Follows:

- Operating Profit Margin: 99.50%

- Net Profit Margin: 24.06%

- Earning Per Share: 4.91%

- Dividends Per Share: 1.50%

Also Read: HDFC AMC Share Price Target.

For More Official Details Visit: IRFC Website.